Commodity Channel Index (CCI)

Commodity Channel Index (CCI) is a hugely popular indicator among traders. Although novice traders tend to pay little attention to CCI in the beginning of their lerning curve, later they return to discover amazing potential and beautiful simplicity of the CCI indicator.

There is a variety of CCI indicators, ust by looking at the screenshot below with various CCI versions, it becomes understandable - there is huge package of trading methods behind each simple and custom CCI indicator.

CCI download box

CCI.mq4

CCI.mq4 CCI_Histogram.mq4

CCI_Histogram.mq4 CCI_Divergence.mq4

CCI_Divergence.mq4 Real_Woodie_CCI.mq4

Real_Woodie_CCI.mq4 FX_Snipers_T3_CCI.mq4

FX_Snipers_T3_CCI.mq4 FX_Snipers_Ergodic_CCI_Trigger.mq4

FX_Snipers_Ergodic_CCI_Trigger.mq4 FX_Snipers_Ergodic_CCI_Trigger_Signals.mq4

FX_Snipers_Ergodic_CCI_Trigger_Signals.mq4Indicators built around CCI:

Forex_Freeway_2.mq4

Forex_Freeway_2.mq4 MTF_Forex_Freedom_Bar.mq4

MTF_Forex_Freedom_Bar.mq4Additional CCI reading:

WoodiesCCI.pdf

WoodiesCCI.pdf Trading-Woodies-CCI-System.pdf

Trading-Woodies-CCI-System.pdfFundamentals of trading with CCI indicator

Developed by Donald Lambert, original CCI consists of a single line which oscillates between +/-200.

CCI indicator was created to identify bullish and bearish market cycles

as well as to define market turning points, market strongest and weakest

periods.

Designed for commodities, CCI has quickly found its application in other markets including Forex.

The author advises to use CCI for entries and exits once CCI reaches +/-100. It goes as follows:

When CCI moves above +100, there is a strong uptrend confirmed, therefore traders should open a Buy position. The trade is held as long as CCI trades above +100. Exits will be made when CCI goes back below +100. Opposite true for downtrends and readings below -100.

When CCI moves above +100, there is a strong uptrend confirmed, therefore traders should open a Buy position. The trade is held as long as CCI trades above +100. Exits will be made when CCI goes back below +100. Opposite true for downtrends and readings below -100.

Since 1980 when CCI indicator was first introduces, traders have

found lots of ways to interpret CCI and expand trading rules. all those

methods and views will be cover here.

CCI and its Zero line

An aggressive way to enter the market is to react to CCI's line crossing its zero level.

When CCI moves above Zero, traders would Buy the currency expecting a newly changed trend to hold. Vice versa, when CCI falls below zero, traders would Sell looking to benefit from early signals of an emerging downtrend.

Simple rule:

Above zero - Buyers' territory,

below zero - Sellers' territory;

Above zero - Buyers' territory,

below zero - Sellers' territory;

unless, we have reached an oversold/oversold zone.

CCI overbought & oversold zones

With CCI we can separate indicator readings to 3 zones:

1. Already known, a zone above Zero (bullish) and a Zone below zero (bearish).

Trading rules: when price crosses zero line, Buy/Sell depending on the direction of a crossover.

2. An overbought zone - CCI reading above +100, an oversold zone - CCI reading below -100

Once price moves higher above +100, a strong uptrend has been established. Hold on to a Long position, but prepare to exit as

soon as beautiful tall candlesticks yield place to smaller reversal

candles with long shadows and small bodies.

3. An extremely overbought zone - CCI reading above +200, and an extremely oversold zone - CCI reading below -200.

Take profit & close trades. Prepare for a price reversal.

Summary: CCI indicator signals

Bonus: CCI trading walkthrough

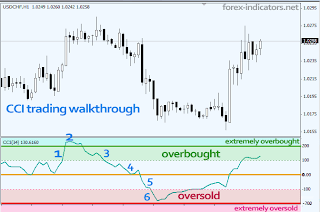

With what we know so far, we can already read and trade with CCI indicator.

Let's walk through the numbers on the screenshot below:

Let's walk through the numbers on the screenshot below:

1 - CCI is in an overbought zone. The moment it entered there, we could

have placed a Buy order, since we know that a strong uptrend has been

established.

2 - CCI rises to an extremely oversold level, this is where we know that

the reversal is near, so the measures are to tighten our stop loss and

either exit as we spot a reversal pin bar candlestick or wait till CCI

exits below 200.

3 - The moment CCI exits +200 zone we should close all remaining Long

trades and look to Sell. With CCI exiting from an extremely overbought

zone is a perfect opportunity to initiate our first Short trade.

At the same time, should we never witness CCI above 200, we'll be still

holding our Buy position open, because CCI continues to trade inside an

overbought zone.

(So, the difference is whether there was a rise above 200 or not. If we

erase #2 event from the chart, we're trading in an overbought zone and

continue to hold out Long position).

4 - As price exits from an overbought zone, we close all Long

positions and can immediately open Short positions / add to existing

Short trades opened at point 3.

5 - CCI crosses its Zero line and now is on Seller's territory. We can open yet another Short trade.

6 - Price enters an oversold zone (below -100), which tells us that a

downtrend is already running strong. We can add up to a Short trade and

hold till we find that CCI rises back above -100.

0 comments:

Post a Comment